florida estate tax rate

Download our checklist to learn about establishing a domicile in a tax-advantaged state. The federal state tax has been.

Florida Property Tax H R Block

Veterans who are at least 10 disabled from wartime service or misfortune and who were honorably discharged are generally eligible for an additional 5000 property tax.

. At the moment Floridas property tax rate is 187. In all Florida counties other than Miami-Dade County the stamp tax owed is 70 per 100 or a rate of 07. Section 197122 Florida Statutes charges all property owners with the following three responsibilities.

Cannot increase by more than 3 of the previous years assessment or the Consumer Price Index whichever is less. Ad Due to the new tax laws relocating to Florida could have many tax advantages. Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics.

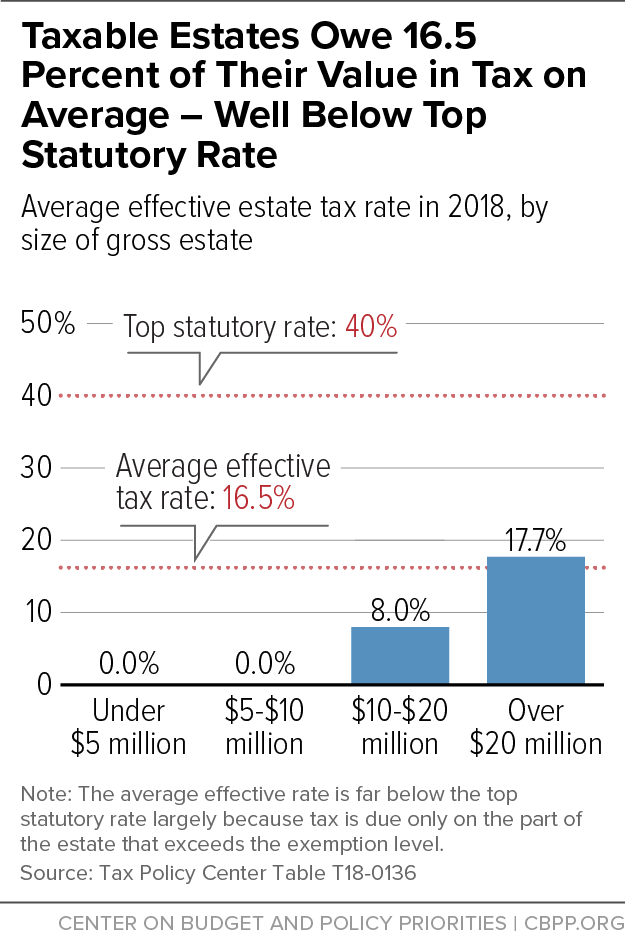

Property tax is delinquent on April 1 and is subject to penalties. Additionally counties are able to levy local taxes on top of the state. As a result of recent tax law changes only those who die in 2019 with.

We dont make judgments or prescribe specific policies. 1 the knowledge that taxes are due and payable annually. If you earned 100000 last year and paid 20000 in income taxes you would get up to that amount in refunded taxes.

The average effective property tax rate in Florida is 194. Property taxes in Florida are implemented in millage rates. Florida estate taxes were eliminated in 2004.

By Jon Alper Updated July 22 2022. The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. If youre putting together your Florida estate plan its wise to consider whether youll need to pay a federal estate tax.

The consideration is rounded up to the nearest increment of 100. A millage rate is one tenth of a percent which equates to 1 in taxes for every. Each county sets its own tax rate.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. Florida also has no gift taxThe federal government allows 15000 a year to be gifted to any friend relative or associate. The Florida corporate incomefranchise tax rate is reduced from 55 to 4458 for taxable years beginning on or after January 1 2019 but before January 1 2022.

In Florida local governments are. Get Access to the Largest Online Library of Legal Forms for Any State. 24 in the nation for effective property tax rates in 2021 with the average homeowner paying 089 of their homes value in taxes each year.

Property taxes will be due in one lump sum beginning Nov 1 and payable through Mar 31. See what makes us different. Florida Property Tax Rates.

In Florida a home worth 18240000 is expected to pay 177300 in property taxes per year. Florida Statutes 197333 states Taxes shall become delinquent on April 1st following the year in. Key Title can assist you in understanding all aspects of purchasing real estate.

The Florida tangible personal property tax is a tax on business assets. 2 the duty of. Florida does not have an inheritance tax.

Counties in Florida collect an average of 097 of a propertys assesed fair. Instead individuals and families pay a federal estate tax on transferring property upon death when an estate exceeds a specific threshold. Johns County Taxes Shall Become Delinquent on April 1 2021.

Previously federal law allowed a credit for state death taxes on the federal estate tax return. The average property tax rate in Florida is 083. The state charges a 6 tax rate on the sale or rental of goods with some exceptions such as groceries and medicine.

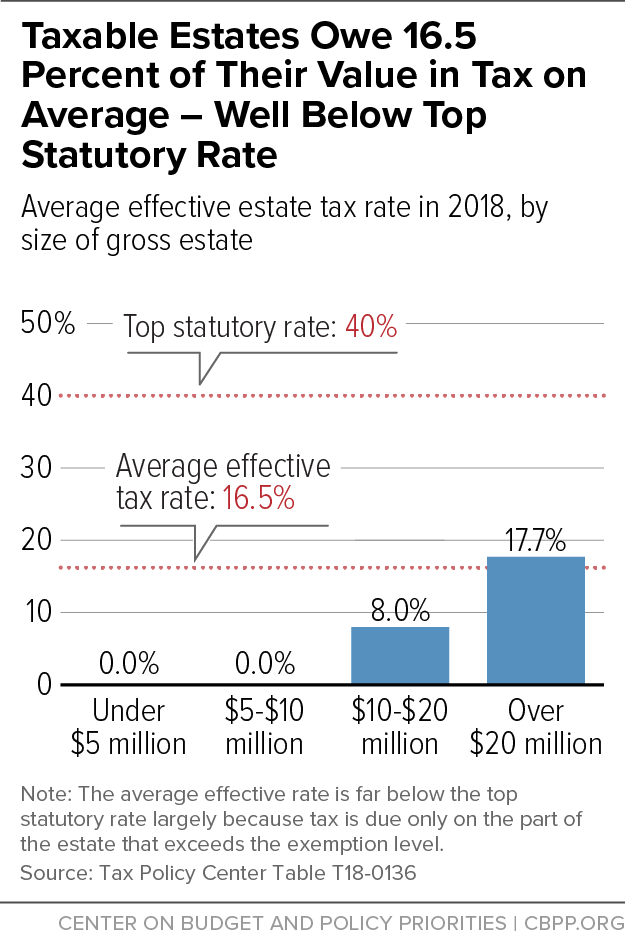

69 rows The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. The tax rates for the state county and city are listed here.

The federal government then changed the credit to a deduction for state estate. Most types of businesses are subject to this tax even if unincorporated or a single independent contractor. 9 hours agoThink of the process as adding tax deductions.

Florida real property tax rates are. There are also special tax districts such as schools and water management districts that. WalletHub ranked Florida no.

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Florida Estate And Inheritance Taxes Estate Planning Attorney Gibbs Law Fort Myers Fl

Estate And Inheritance Taxes Urban Institute

Florida Dept Of Revenue Taxpayers

Where Not To Die In 2022 The Greediest Death Tax States

Biden Estate Tax 61 Percent Tax On Wealth Tax Foundation

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

Elegran Insights Research Note A Taxing Conversation Elegran Real Estate

The Tax Rate On A 2 Million Home In Each U S State Mansion Global

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Does Florida Have An Inheritance Tax Doane And Doane P A

Does Florida Have An Inheritance Tax Alper Law

/cdn.vox-cdn.com/uploads/chorus_image/image/50999479/609557326.0.jpg)

Hillary Clinton Wants A Top Estate Tax Rate Of 65 Percent The Highest Since 1982 Vox

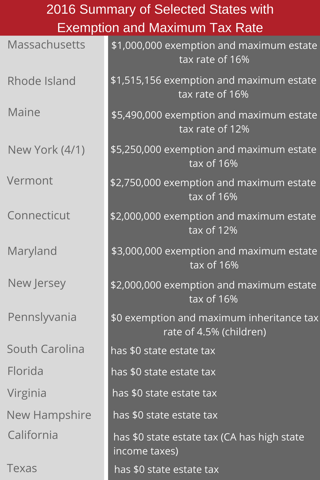

How Changing Residency Affects State Estate Tax And Income Taxes